Countries With the Most Debt

A country’s external debt refers to money owed by a country to foreign countries, institutions or individuals who are outside its borders.

A country’s external debt refers to money owed by a country to foreign countries, institutions or individuals who are outside its borders. Such debt can be settled through cash repayment, as well as through imports or other acceptable means. Ordinarily, the loans and the interest are paid in the currency the loan was made. A debt crisis may be experienced if a country having a weak economy is unable to its debt. According to the CIA World Factbook, these are the most indebted countries in the world.

The United States (US)

The US has a total of 29.27 trillion dollars of external debt, translating to around 45% of the total debt owed. Its two largest creditors are China (roughly $1.18 trillion) and Japan (roughly $1.06 trillion). The US government is wary of heavy reliance on foreign debt and keeps its Net International Investment Position (NIIP) at a manageable level to avoid economic downfall brought about by any sudden foreign debt reduction.

The United Kingdom (UK)

The UK has a total of $8.12 trillion external debt, translating to about 27% of the total debt owed. It has a better NIIP compared to the US, because of better foreign investments estimated to be about $7.6 trillion.

France

France had a total of $5.36 trillion external debt by the end of 2017, which is almost the equivalent of its GDP. That comparison makes it among the top countries with a large amount of national debt. Its economy enjoys many millionaires and large number of business who supply globally.

Germany

Germany’s external debt is around 5.36 trillion. This is about 64% of its GDP, making it a more stable economy compared to other European countries. Its credit rating has been improving over the years as a result of falling national debt. A ripple effect of that status is that Germany has become a more attractive country for investment.

Foreign Debts and the National Economy

Foreign debt is a key indicator of the borrowing ability of a country, which in turn affects its economic growth. On the other hand, the foreign debt may not affect a nation’s borrowing ability if it is owed more foreign debt than it has. Countries that have had adverse foreign debt usually resort to debt sustenance measures to keep their economies afloat. For example, such countries may opt to reschedule payments, increase its exports and encourage more local investments.

Countries With the Most Debt| Rank | Country | External Debt |

|---|---|---|

| 1 | United States | $17,910,000,000,000 |

| 2 | United Kingdom | $8,126,000,000,000 |

| 3 | France | $5,360,000,000,000 |

| 4 | Germany | $5,326,000,000,000 |

| 5 | The Netherlands | $4,063,000,000,000 |

| 6 | Luxembourg | $3,781,000,000,000 |

| 7 | Japan | $3,240,000,000,000 |

| 8 | Ireland | $2,470,000,000,000 |

| 9 | Italy | $2,444,000,000,000 |

| 10 | Spain | $2,094,000,000,000 |

More on Graphicmaps

Published on 2019-11-06

What is a Trade Embargo?

Published on 2019-11-04

Which Two Countries Used to Have the Same Flag?

Published on 2019-09-16

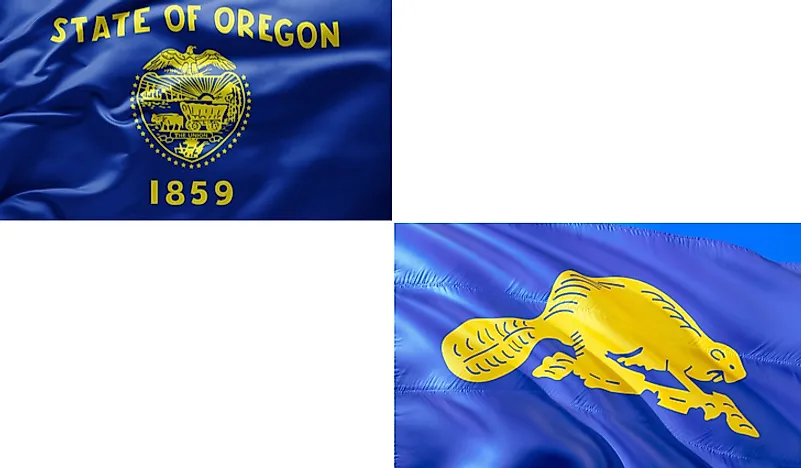

What Is the Only Two-Sided State Flag?

Published on 2019-09-16

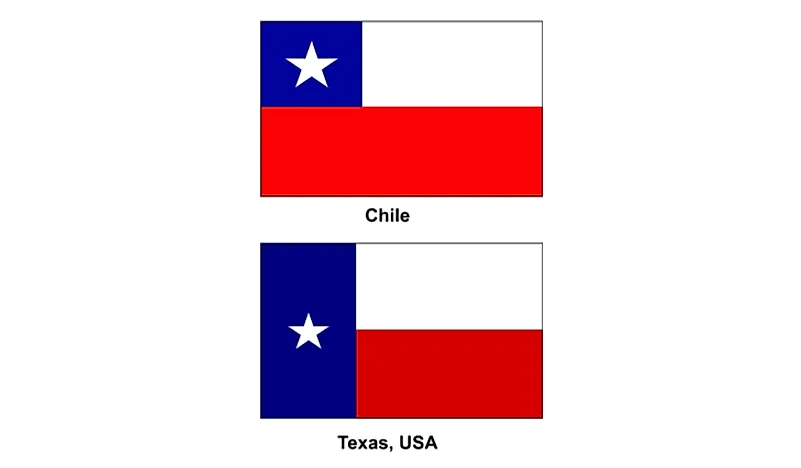

Which Country Flag Looks Like the Texas Flag?

Published on 2019-08-29

Flags That Resemble the US Flag

Published on 2019-08-20